Harvey Insurance Ltd. Blog

|

|

Nobody thinks it’s okay to drive while distracted, yet most people have likely done it at some point. Distracted driving can be just as dangerous as drunk driving — and these days, it’s much more common. But it’s not just texting that puts drivers at fault. Anything that takes your attention away from the road is a distraction. Eating, drinking, smoking, vaping, fixing your hair, putting on makeup or even fiddling around with the stereo could all be considered distractions.So, are you guilty of these things? Sure, we can all get distracted, but the key is to consciously try to change this behaviour. Shocking split-second distractions Sending a speedy text reply — even an emoji — can take your eyes off the road for five seconds. Would you drive blindfolded for half a block at 90 km per hour? That’s the equivalent, and it would be terrifying — for the driver, passengers and everyone around. Source: The Insurance Bureau of Canada (IBC) Penalties for distracted drivingWhile laws and penalties vary from province to province, there’s a national ban against using a mobile or handheld device while driving. Penalties could include a fine, the loss of demerit points or even a driving suspension. The penalty will depend on the type of license you have, how long you’ve been driving and whether it’s your first infraction — and this could also impact your insurance rates. If you endanger the life of another person because of distracted driving, you could also be charged with careless driving, which carries higher penalties that could include jail time and a license suspension. In the worst-case scenario, you could be charged with dangerous driving, which is a criminal offence and carries significant jail terms for causing bodily harm or death. Even if you’re not texting while driving, you could still be pulled over for distracted driving. For example, eating a bag of chips or sipping a coffee could impair your driving — even if it doesn’t fall directly under your province’s distracted driving law. Driving with your pet on your lap could also be deemed a distraction. In B.C., this could result in a charge related to driving while your control or view is obstructed, which are sections of the Motor Vehicle Act. How unsafe am I? Being distracted affects a driver’s decision-making, which could lead to accidents and injuries. Collision data shows that a driver using a mobile phone is four times more likely to crash than a driver focusing on the road. And deaths from collisions caused by distracted driving have doubled since 2000. Source: Ontario Government Tips for avoiding distracted drivingWhile there are countless random things that can steal your attention, it’s likely that you’ve encountered the same situations every time you drive. So here are five very common things that you can do right away to help you focus more on the road. 1) Switch off temptation & silence your phone Studies have shown that when we receive a notification — including ‘likes’ on social media — that ping sends dopamine to our brains, and we respond like the proverbial Pavlovian dog. But if you can’t hear the sound or feel the vibration, you won’t be tempted to look at your device. So turn off your phone, mute the volume or, better yet, use the 'do not disturb' feature when you get in your car, which will silence notifications, calls and texts. And while you’re at it, toss the phone in the glove compartment or the back seat where it’s out of reach. 2) Use apps to block calls while driving Take it to the next level and consider using an app that blocks incoming texts and calls while you’re driving, especially if you regularly commute for long periods of time. These apps can also send out an automated reply that lets people know you’re driving and can’t get back to them at the moment. If you’re worried you’ll miss an important call or not respond in a timely manner, these auto-replies can at least act as a stop-gap until you reach your destination. 3) Keep your pet safe While we might like the idea of driving with our furry family member in the passenger seat, it’s simply not safe — for you or your pet. “In the event of a crash, even the smallest dog can generate up to 500 pounds of projectile force. A bigger dog, like a husky, could become a 2,400-pound projectile! Any unrestrained animal, but especially larger dogs, would be at risk of serious injury or even death in an accident,” according to an article in Canada Drives. If your pet is accompanying you, use a harness, crate or dog car seat to keep Fido safe and secure. Try to keep them in the backseat if possible, which will help limit entering your peripheral vision while driving. 4) Pull over when eating and navigating

If you’re starving, don’t wolf down a takeaway meal while behind the wheel. Instead, eat it in the parking lot or find somewhere safe to pull over. The same applies if you need to send a text or make a call. If you’re lost, don’t try to bring up Google Maps on your phone or program a GPS system while driving. It can be tempting to just quickly pull up an address, but again, pull over and spend the extra minute to do it the safe way. 5) Use voice commands and hands-free communications — sparingly You can use voice commands to program your GPS device or for hands-free Bluetooth-enabled communications. But use these sparingly because they aren’t foolproof. Just trying to fiddle with technology can also distract you. (How many times does your voice recognition understand the wrong command?! Frustrating.) And if you’re deep into a phone conversation on speaker, say with your spouse, kids or work, you’re still going to be distracted even if you’re using Bluetooth. Recently, the B.C. Supreme Court ruled that wearing both earbuds connected to a smartphone counts as a distracted driving offence, so that’s not a great option either. Driving while distracted can result in a hefty fine, demerit points and even a driving suspension. But it can also negatively impact your insurance rate. By taking a few simple steps, you can stay focused on the road and keep yourself — and the other drivers around you — safe from distraction. Blog Source: https://www.wawanesa.com/canada/blog/5-tips-distracted-driving

0 Comments

Apart from heating and cooking equipment, home appliances account for over 700 residential fires across Canada each year.¹ In the US, the vast majority of fires (92 percent) involve clothes dryers.² Here’s a safety checklist for your clothes dryer, which will also help increase its efficiency and extend its lifespan. Clothes Dryer Ducting

Every Month

Every Year

SOURCE: Stanley Mutual

1 Statistics Canada, Fire statistics in Canada, 2005 to 2014 2 National Fire Protection Agency Report. Home Fires Involving Clothes Dryers and Washing Machines © The Boiler Inspection and Insurance Company of Canada. All rights reserved. This article is for informational purposes only. All recommendations are general guidelines and are not intended to be exhaustive or complete, nor are they designed to replace information or instructions from the manufacturer of your equipment or software. Contact your equipment service representative or manufacturer with specific questions. Under no circumstances shall BI&I or any party involved in creating or delivering this article be liable for any loss or damage that results from the use of the information or images contained in or linked to in this article. You hear the sound of crunching metal, your heart is racing, your palms are sweating— you’ve just been in an accident.

The backyard skating rink is a beloved tradition for families across the country. It calls to mind memories of lacing up skates on chilly winter nights, shooting the puck around with friends, then sipping hot cocoa and snuggling up by a crackling fire. If you’re tempted to bring back your childhood in the form of a DIY ice rink, it’s important to understand what is and isn’t covered under your home insurance policy and take the right measures to protect yourself in case anything goes wrong.Building a skating rink in your yard is a liability risk. Like a swimming pool, a skating rink increases the chances of someone getting injured on your property or causing damage to a neighbour’s property. What if someone slips and breaks a leg? What if your kid accidentally shoots a puck through your neighbour’s window? Or what if your rink floods your neighbour’s yard when it melts in the spring? Even if someone gets hurt after sneaking into your yard for a late-night skate, you could still be considered responsible. This is why it’s so important to make sure you have enough third-party liability coverage on your home insurance policy to protect you if you’re held liable for an injury or property damage. If you’re planning on building a skating rink on your property, ask your home insurance broker if your existing coverage is enough, or if they recommend increasing your liability limit for this new risk.

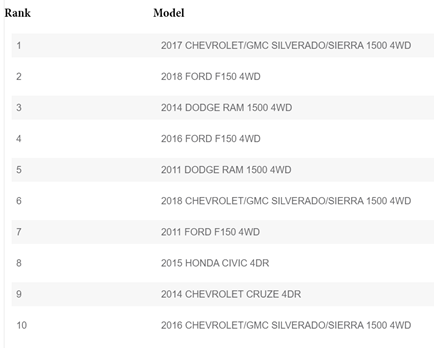

According to the Insurance Bureau of Canada, auto theft costs Canadians close to $1 billion each year. These vehicles were at the top of car thieves’ shopping lists in 2020: Was your vehicle at the top of car thieves’ shopping lists in 2020? Find out now and take some simple steps to avoid being an easy target for vehicle theft.

Welcome to our new insurance agency blog! This is our very first post. We're not quite sure what we're going to write about here, but the plan is to create helpful content for customers and prospective clients about information that is relevant to you. We hope you'll come to view this as a top resource for keeping your family and your finances safe. Here are a few of the topics we may be writing about:

Stay Tuned! |

Contact Us

(506) 366-2022 Archives

April 2021

Categories |

RSS Feed

RSS Feed